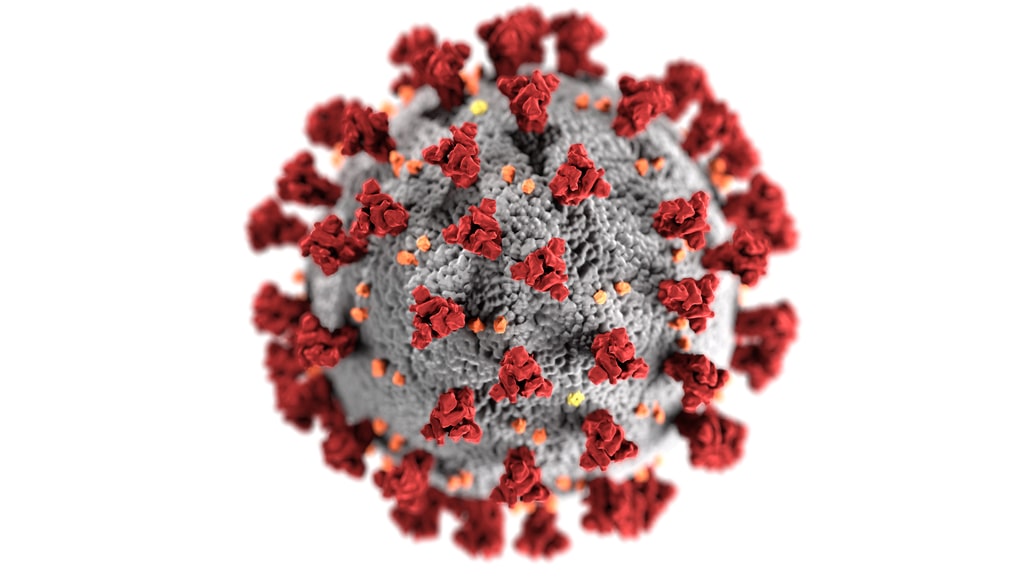

Who hasn’t. Accountants like the team at Accounting Tax Solutions are usually busy supporting their clients in the midst of tax season, but instead, we are battling a second year of COVID-19 restrictions and juggling business-as-usual requests in addition to constantly changing government stimulus packages.

With vaccination schedules providing a light at the end of the tunnel, many businesses are still feeling the immense impact that restrictive lockdowns have had on their business and the entire Australian economy.

As of August 2021, 292,000 applications for business support have been lodged in NSW alone. $2.3 billion of payments have been approved but only $1.8 billion paid out, which means many businesses are still waiting for approved support.

Until restrictions ease completely and borders reopen to the world, accountants, such as us here at ATS, have been playing a critical role in helping small and large businesses to access the funds they need to continue to operate and keep staff employed.

- Keeping up to date

So that you don’t have to follow the news constantly, we have had our finger constantly on the pulse to provide you with up to date, relevant news regarding new stimulus. For example, the Queensland government has announced financial support for small and medium sized businesses.

Although a lifeline, these packages are notoriously difficult to understand and even more complex to access. That is why we have made it our duty to efficiently provide support for businesses who need to know whether they are eligible or not.

- Proving eligibility

Beyond understanding eligibility, businesses need to know how to accurately prove it in order to be seamlessly approved and support is provided when it is available.

Thankfully, we have welcomed improvements in our technology that enable us to streamline data collection and analysis. This means that we have been able to quickly provide businesses with the information that they need to receive resources available.

It would otherwise take us hours per client to source the relevant data needed to prove eligibility for stimulus packages, as, for example, we need to prove a decline in revenue during certain periods of time, which, without modern technology, would likely be impossible.

New mechanisms such as cloud computing, blockchain technology and automated payrolls have improved our ability to provide you with the services that you need, particularly throughout this pandemic and our response to it.

You will only continue to reap the rewards of our commitment to sourcing the best possible technology and information and we look forward to a more prosperous future together.